Irs Estimated Tax Payment Calendar – “Taxpayers have extra time – up to six months after the due date of the taxpayer’s federal income tax return for the disaster year (without regard to any extension of time to file) – to make the . It is tax time and your accountant is not only telling you how much you owe for last year’s taxes but also breaking the news that you must pay estimated the IRS has a nifty tax withholding .

Irs Estimated Tax Payment Calendar

Source : www.kitces.com

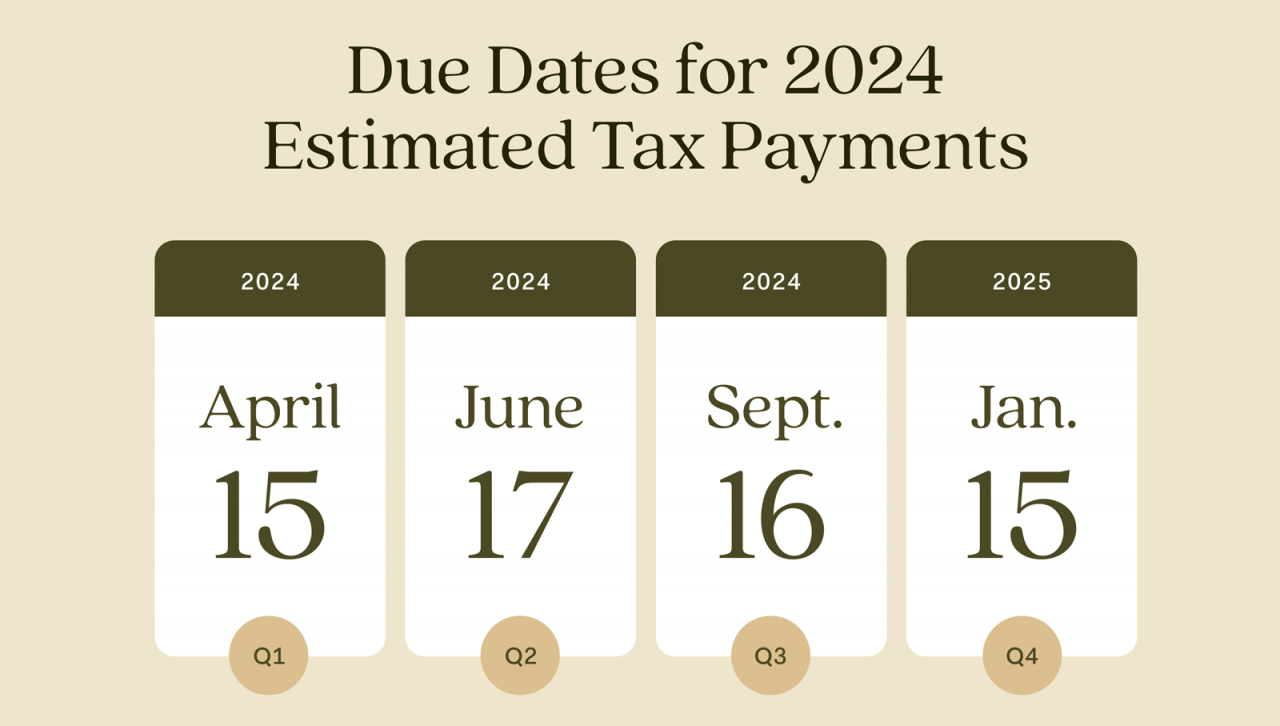

Tax Due Dates For 2024 (Including Estimated Taxes)

Source : thecollegeinvestor.com

Tax Refund: When will I receive my refund? The estimated schedule

Source : www.marca.com

IRS reminder: 2024 first quarter estimated tax payment deadline is

Source : larsonacc.com

Payment Calculations & Noted Calendar Dates Expat Tax | US Expat

Source : www.taxesforexpats.com

IRS Issues Reminder for Estimated Tax Payment Deadline Taxing

Source : www.drakesoftware.com

2024 IRS Tax Refund Calendar Estimate When You Will Get Your Tax

Source : www.cpapracticeadvisor.com

How to reduce estimated tax penalties with IRA distributions

Source : www.financial-planning.com

3.11.10 Revenue Receipts | Internal Revenue Service

Source : www.irs.gov

2024 IRS Tax Deadlines Filing Calendar

Source : www.aarp.org

Irs Estimated Tax Payment Calendar Reducing Estimated Tax Penalties With IRA Distributions: If you want to pay your federal estimated taxes online, the easiest way is to use IRS Direct Pay. Paying online offers confirmation that the payment made it to the agency, reducing the chance of . The Internal Revenue Service ( IRS) has announced tax relief for individuals and businesses in parts of Kentucky and West Virginia affected by severe storms, straight-line winds, tornadoes, landslides .